STRANGER THINGS

CHURNING SEASON

Happy Tuesday War & Peaceniks! Ready for Churning Season?

During earnings season, all the public media and tech companies report various key performance indicators. Each quarter, I read all their reports. Of the many things that confound me about the spin and spreadsheets in these reports, nothing baffles me more than the absence of one data point: Churn.

In streaming, Churn underpins nearly everything. Attracting Subscribers doesn’t matter if every month, you lose them all. Churn effects a media platform’s content spends, programming roll out, marketing strategies, and pricing. All three of the major the mobile carriers report their churn every quarter. Yet Churn is barely or not mentioned in the earnings reports of all the major media streamers.

This is Netflix’s Investor Relations page. There, you can find their quarterly letters to shareholders, transcripts of all their earnings calls, and all their quarterly financial statements. The word Churn does not appear in their letters. Churn is mentioned just five times in the 18 page transcript of their 3Q earnings call. The actual rate of their Churn is never discussed.

So, each quarter, after earnings season, I eagerly await the Antenna SVOD Growth Report, so I can get the key information about the streamers that they won’t not tell us. Antenna’s 3Q report just came out, and while I haven’t been able to go through all of the data with a fine toothed comb yet, I have dug deeply into Churn…

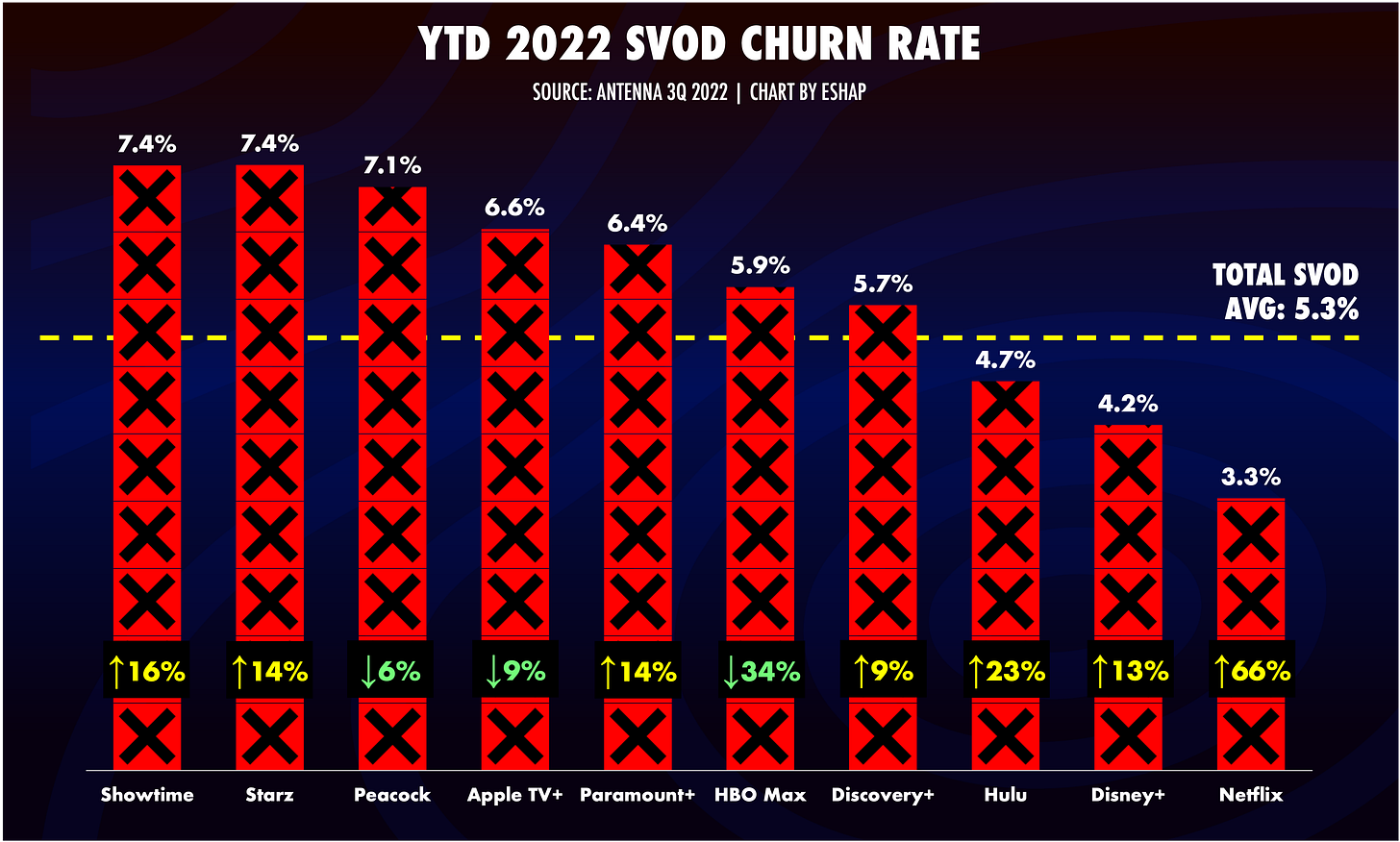

Only three of the top ten major streamers have lowered their Churn this year. Peacock and AppleTV+ have seen appreciative drops in their traditionally high cancelation rates, while HBOMax has lowered their Churn by a massive 34% in 2022 YTD.

[Antenna still does not track Amazon Prime. Feel free to annoy them about that.]

All the other seven major streamers have seen their Churn rise substantially this year - six of them with double digit increases. The three biggest platforms saw the highest Churn growth. Netflix’s average YTD Churn remains the industry’s lowest, but it is up a massive 66% YoY. (In a moment I’ll show why that stat is actually a generous view of their current Churn trajectory.)

You can see that the industry average for churn YTD in 2022 is 5.3%. Losing 5% of your users every single month is a troubling stat for SVOD. But the trend line tells an even worser story.