Macro Soft

How To (actually) Read An Earnings Report

Happy Friday War & Peaceniks! Let’s read some tea leaves.

This week, one of the Biggest Tech Death Stars, Microsoft, issued their earnings for 4Q 2022. In the moment, the reaction was a collective Wall Street GASP! Their revenue grew just 2%, while net income fell 7%. Microsoft’s stock immediately fell 5%, taking the entire Tech market with them.

Then, as some analysts actually (get this) read their earnings, things shifted. By the end of day Thursday, Microsoft shares were up nearly 6% for the week.

Thus, we learn an important lesson about earnings reports: It helps to read them. When you do, you are far better able to cut through the noise of business trade clickbait, and ignore the spinning plates of baloney from company officers, paid to make you think about things that aren’t there.

Last week, I wrote how Netflix did an amazing job of fooling everyone into thinking everything is just fine, while simultaneously, their CEO was stepping down, and their actual numbers were on fire, in a bad way.

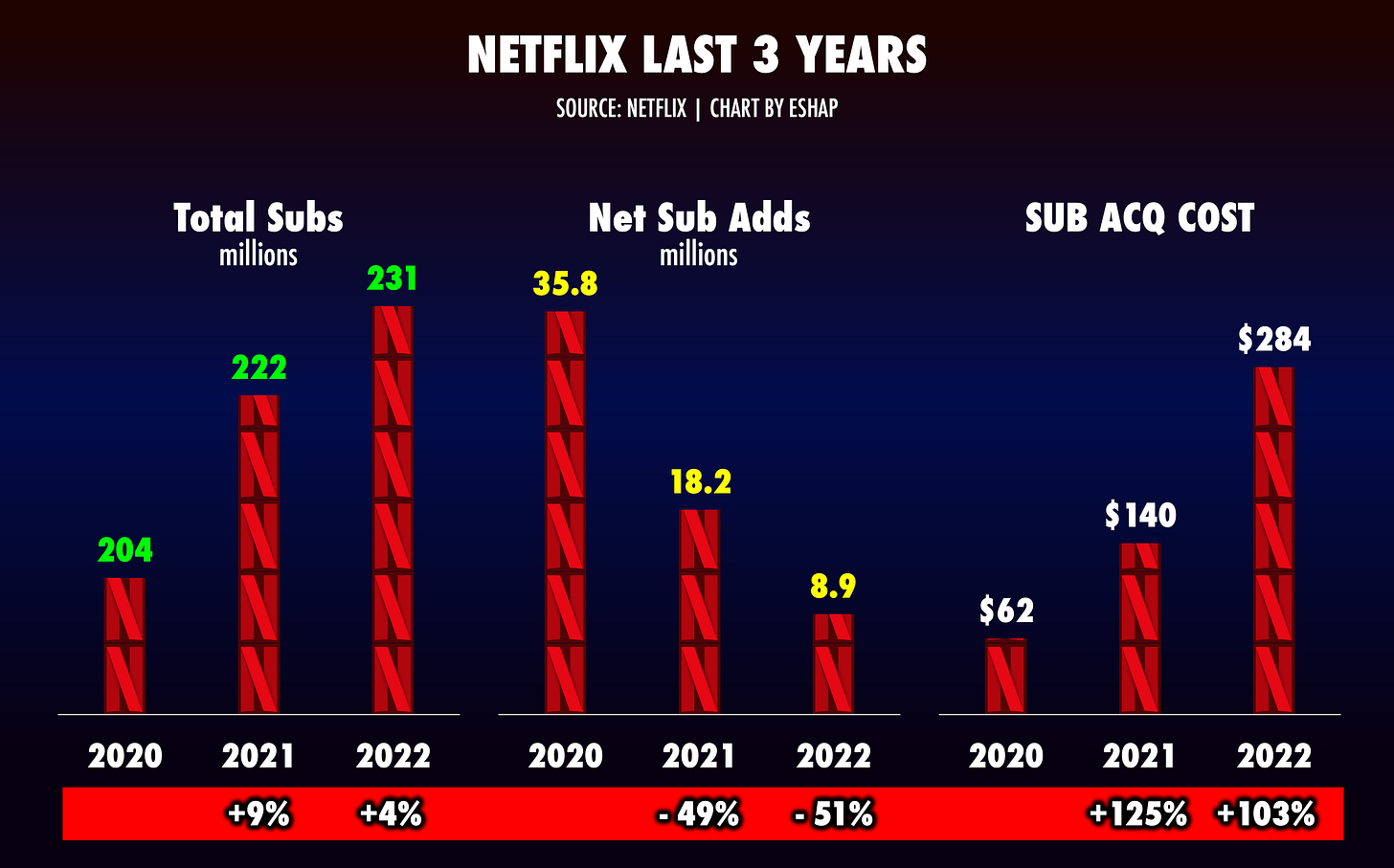

Netflix spent their 4Q earnings call beating their chests about beating their subscriber projections and talking about their new ad tier. In reality, their sub growth is in speedy retreat, falling 51% YoY, and their cost per new net sub continues to skyrocket. It doubled in 2022, after rising 125% in 2021. Meanwhile sign-ups for their ad tier are the definition of lackluster, which is why they had to give back money to advertisers during 4Q.

Yet nearly all analysis after their earnings, and since, has focused entirely on their subscriber upside and Reed Hastings’ gentle exit.

“Despite these concerns in fourth quarter, Netflix increased their subscriber counts by 7.66 million, easily exceeding the expectations of Wall Street of 4.57 million net new subscribers. Netflix wound up 2022 with 230.75 million subscribers, a year-over-year increase of 4%.”

Look at that chart above. Then read the quote below it.

The Forbes article regurgitates Netflix execs’ talking points, nearly verbatim, then digs no deeper. Yet, if you truly look under the hood, you see engine trouble. They spent $2.5 billion in marketing to net just 9 million subs for the whole year, while also falling short on ad impressions in their new ad tier, that is supposed to compensate for their fast-falling sub growth. None of this is mentioned by Forbes, nor most of the analysts whose job is to, y’know, analyze those very numbers. That’s why Netflix’s share price popped more than 8% after their earnings.

The initial knee jerk by Wall Street in response to Microsoft’s earnings was based entirely on their revenue rising just 2% and their net income falling 7%. The reaction was so intense, it dragged down the entire stock market.

Yet, when you take the time to compare and contrast…