Happy Monday War & Peaceniks. Let’s Get Ready To BUUUUUUNDLE!

Last week’s earnings reports from Comcast and Charter showed that the unbundling of America’s Media ecosystem is actually accelerating. Charter’s video subscribers fell 5% in the last year, their landline phone users fell 11%, and even their broadband sales have flattened. Comcast lost 614,000 video subs in Q1, and new broadband sign-ups fell by a massive 98%. In both cases, homes with the Triple Play - video, phone, and internet - have stop growing and are now the most likely to cancel services.

As I wrote here, for decades the residential Triple Play of services has been an anti-churn protective shell around the entertainment industrial complex. It’s disintegration is the central issue of American Media’s continuously growing existential crisis.

And yet, 60% of American households now have the bundle we know as Amazon Prime - 172 million Prime members in the US bundle free delivery, Prime Media, gaming, Amazon music, and various other Amazon services. Even a substantial increase in price last year didn’t seem to dampen Prime memberships.

This is at the heart of a thesis I’ve been selling for more than a year: Consumers are leaving the OG bundle, because it’s rooted in the consumption of last decade, but they still crave the convenience and efficiencies of next-Gen Lifestyle Bundles, catered to how lives are lived in the 2020s. Like Prime. Which is why there should be, and very likely will be, more.

If you want to know what types of Lifestyle Bundles Media consumers want, you simply need to ask them. Consumers now curate their very own personal bundles: Arrays of Media they manage on their phones, and keep in their pockets. A Maslow’s Hierarchy of Feeds.

For a year now, Hub Entertainment Research has been asking consumers these very questions. Their Battle Royale tracking study tracks how many Media services they use, which they consistently consider cancelling, and which they consider must-haves. Interestingly, Hub tracks these not only by brand name services, but also by category of platforms. I consulted with Hub on their latest wave of Battle Royale, specifically around the question of bundling, and they’ve given me a first exclusive look at the results.

You can see that, based on this latest wave, Media consumers now see premium paid SVOD services as the most must-have category of entertainment. Social media comes in a close second, and music streaming garners must-have status from more than two thirds of respondents. However, in findings that I think buck most of Media’s conventional wisdom, reading (digital or physical “print”) is seen as a must-have by 69% of those asked - more than music, sports, gaming, and free streaming video. Pay close attention to this datapoint as we go along.

And, despite everything I just said about the disintegration of the residential bundle, and as a counterpoint to all that Comcast cord cutting, 64% of respondents say that they must-have their Bundled Pay TV service (traditional or virtual).

However, you cannot look at the American Media audience as a monolith. When you dig into the demos, generational nuances emerge.

Media consumers under 35 value social media most - significantly more than their over-35 counterparts - making it their top must-have; while the Pay TV bundle falls out of their top five, and gaming leaps into the top ranks. Again, though, reading hangs in there as a top must-have medium, surprisingly tied with gaming. Conversely, consumers over 35 put Pay TV in their top three must-haves, and place reading nearly on par with premium streaming video.

That’s not to say that these priorities are set in cement. I’ve written a great deal of late about serial churning - the tendency of Media users to use up, and then quickly discard their various entertainment services. This wave of Hub’s Battle Royal shows the mindset behind that phenomena.

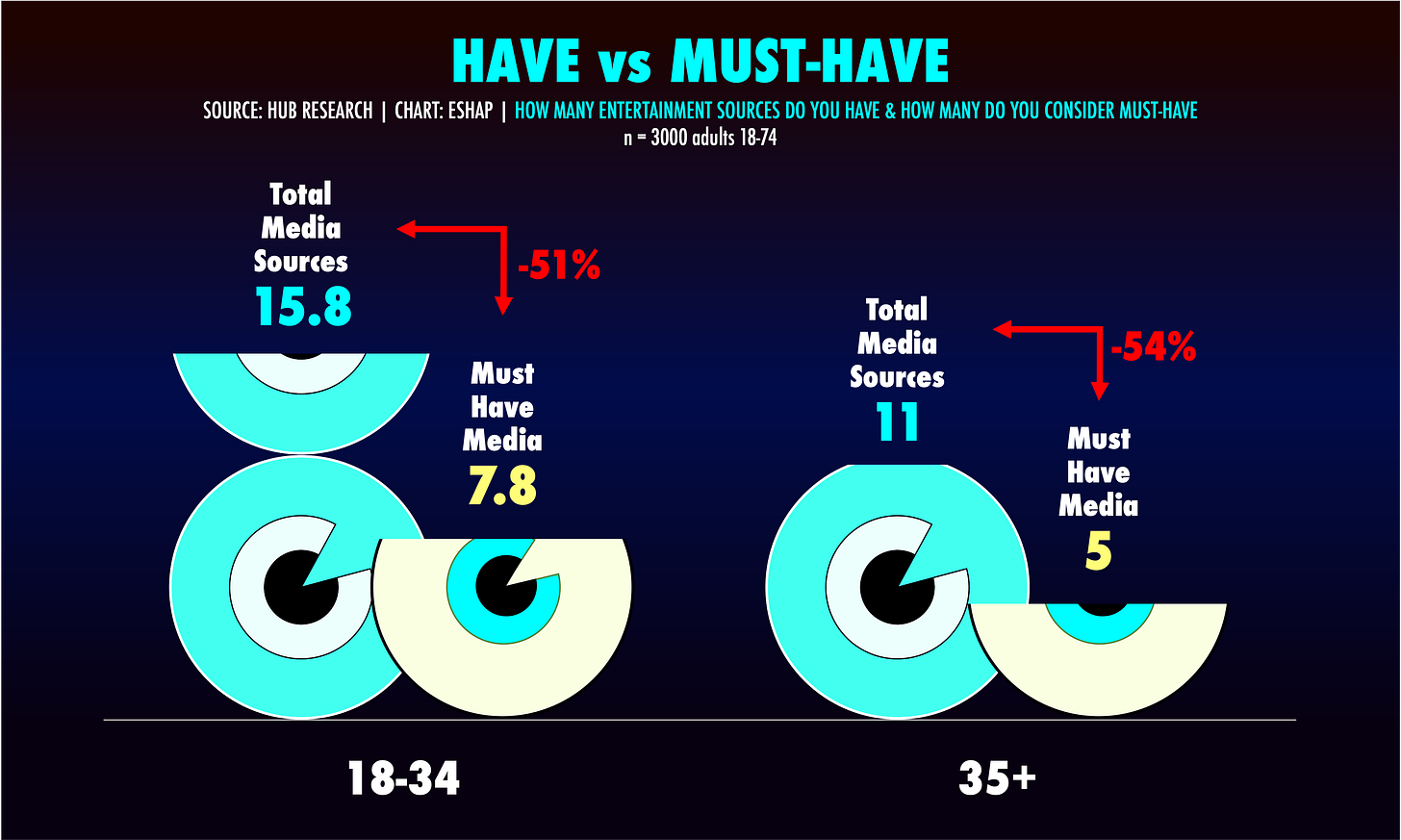

Younger consumers regularly use, or subscribe to, an average of sixteen Media/entertainment services. But they view less than half of them as “must-haves”. Audiences over 35 average fewer services, at eleven, and consider just 46% of them must-keep providers. In the sea of Media choices, acquiring a regular user is a costly and major accomplishment. But this data shows that for many platforms and services, these wins are increasingly fleeting.

This is reinforced by a recent survey of subscribers I did with Publishers Clearing House which showed that most Americans now reconsider the majority of their Media subscriptions as a normal course of their entertainment lives. Just 7% say they’ll stick with the platforms they have now.

Seven percent.

These two studies demonstrate the central crisis playing out in the Media industry:

93% of consumers are constantly rethinking more than half of the entertainment services they use.

Given the constantly confusing cacophony of content and Media coming at them like a firehose, households and individuals are restocking their personally curated content bundles on the regular - based on the content each platform has available, and the entertainment budgets each consumer has available. 82% of respondents say that “there are too many options,” 82% say they are “at their maximum media spend", and 73% say they are “not adding new services, but rather swapping them in and out.”

Yet, almost no one cancels their Prime membership. Every time I present to an audience, I ask who are Prime members. In almost every case, nearly everyone raises their hands (172 million Prime members in the US is more than 2X Netflix). Then I ask who is seriously considering canceling their Prime membership this or next month, and very few hands stay up.

And that, dear readers, is the case for a Lifestyle Bundle. Which begs the question: What does a Lifestyle Bundle look like, and what the heck is in it?

Not so coincidentally, Hub asked consumers that very question. Respondents were given an array of Media and entertainment choices, and asked to pick only five and create a Lifestyle Bundle to which they’d be likely to subscribe. Then they used a latent class model to identify segments based on the items viewers chose (or didn’t choose) to generate the categories of bundles consumers would most prefer.

This whole study makes me nerd out. However, when you look at these results, and then cross pollinate those with the specific Media brands consumers put in their top five must-haves, these Bundle-gories are particularly fascinating.

Keep reading with a 7-day free trial

Subscribe to Media War & Peace to keep reading this post and get 7 days of free access to the full post archives.