Happy Friday War & Peaceniks! Sorry to end the week on a down note, but…

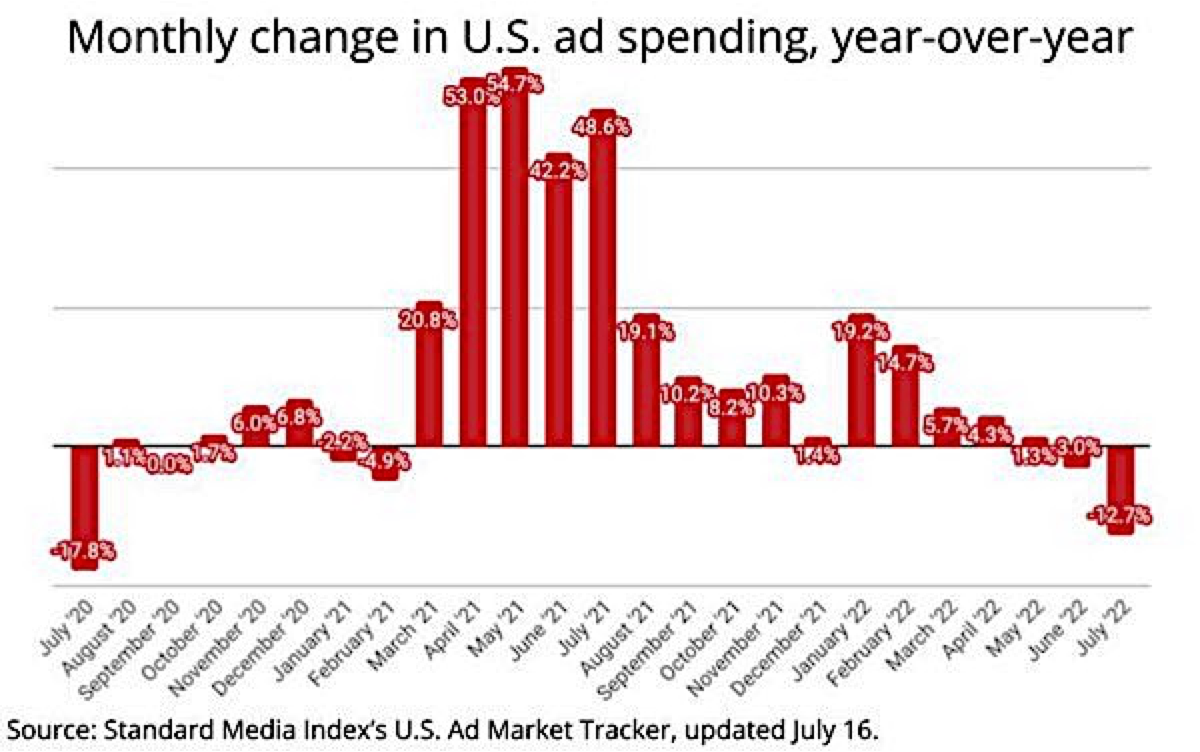

“The U.S. advertising marketplace contracted 12.7% in July versus the same month a year ago, marking its first double-digit rate of decline since July 2020, according to a MediaPost analysis of data from Standard Media Index's U.S. Ad Market Tracker.”

I’ve written a few times about how the recent earnings of the biggest social media companies have all pointed to the fact that we are in an Impression Recession.

The combination of inflation and an enormous glut of ad inventory, plus the new “going out of the house” behavior of American consumers, has created a rising misery index in the ad sales biz.

A big Upfront for OG media companies like Disney and NBCU artificially masked what has been an obvious trend towards retrenchment in the ad buying community. In the ultimate irony, these huge ad commitments in the Upfront are strong indications of an even larger ad downturn than we are seeing now - these chips on premium impressions in 2023 are akin to savings accounts against future risk.

When you dig into the specifics of who are not spending ad dollars…

The only category that shows growth is Travel - because of that new fangled “going out of the house” thing. But Media/Entertainment dropping 23% shows that the very industry who sells ads is feeling bearish itself (not a great sign in the summer when BLOCKBUSTER movies were supposed to be making a big comeback), and major drops in both Financial and Tech indicate, in technical terms: "bad shit ahead.”

The Impression Recession will hit mobile and social hardest - the former because eyes for video are moving off phones and onto to CTVs; and the latter because social media is a bottomless cesspool of Brand un-safety and bots.

But regardless of the sector, the competition for eyeballs and CPMs will be more fierce in 4Q and 2023 than at any point in media history. Come 4Q when both Disney and Netflix flood the zone with billions of new, premium impressions on CTV, the larger media ecosystem will officially have a glut of inventory it will not be able to fill at the prices they expect; and all ad platforms will now be competing with those two mega platforms AND Amazon (with Thursday Night Football), Apple (who controls ads in the AppStore), Microsoft (selling Netflix, but also LinkedIn and gaming impressions), as well as Google (now with even more CTVs) and Meta (who will literally sell anything that isn’t nailed down to make their numbers work).

Programmatic reach will not be enough to compete on price or share with platforms who control huge mind-shares of their consumers. In order to compete for budgets in the Impression Recession, players will need to offer proof of efficacy, excellent data, premium environments and nimble models.

I have been warning about this for some time. But the data makes it impeccably clear: The Impression Recession is here - now. Don’t say I didn’t warn ya!

Next Wednesday, on a new added Zoom Webinar, I will go over ALL this, and dive into new data that shows Subscription Stagflation has arrived simultaneous to the ad crash, creating a perfect media storm. The link and password for the Zoom Webinar is below.

Enjoy the weekend (if I didn’t spoil it for you)!

ESHAP

Keep reading with a 7-day free trial

Subscribe to Media War & Peace to keep reading this post and get 7 days of free access to the full post archives.