Happy Monday War & Peaceniks! How about a trip to Europe for the Holidays‽

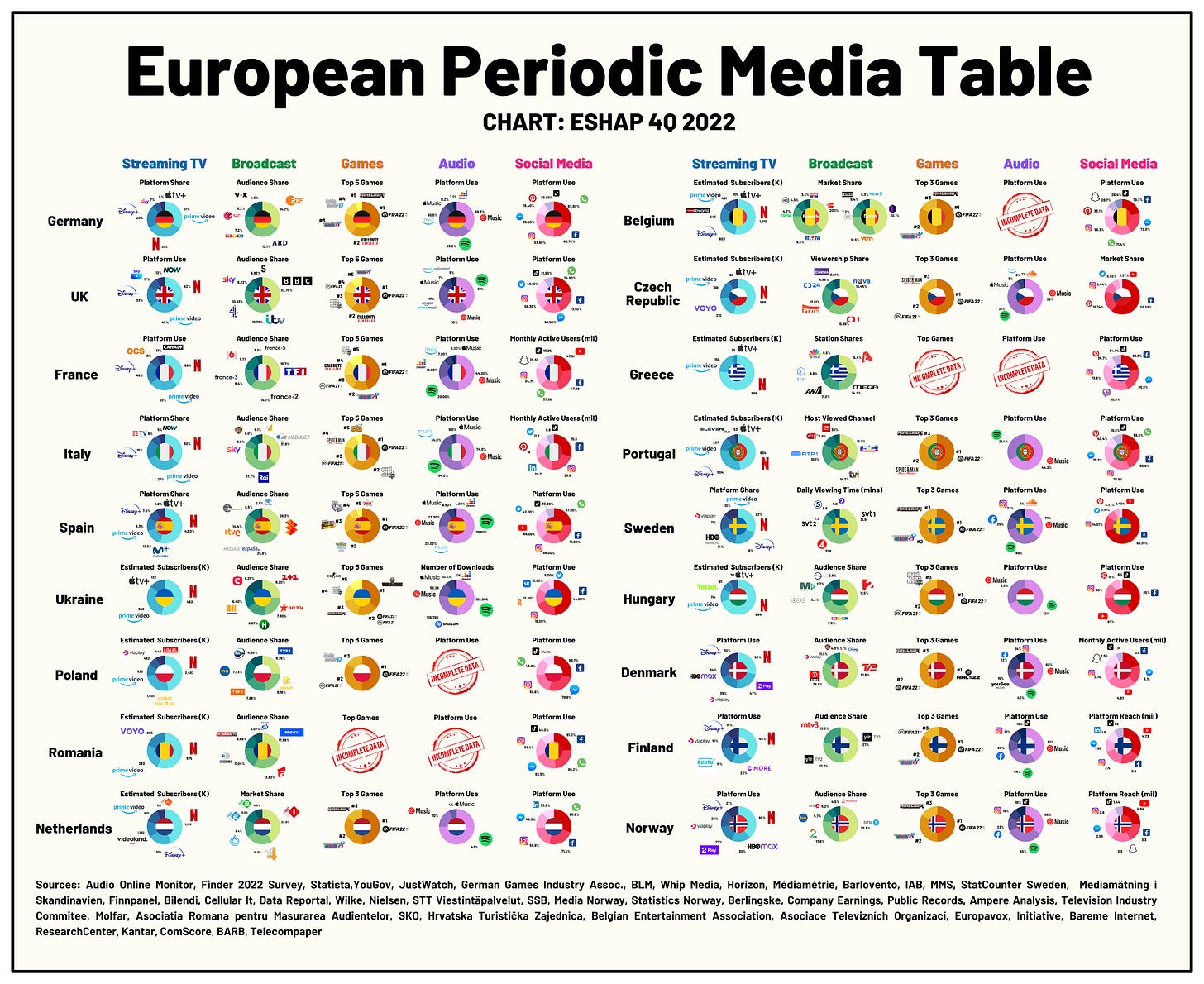

When I released our map of Europe’s Media two months ago, I warned it was a work in progress. So, here’s the European Periodic Media Table 2.0:

We’ve added nine more territories, ranked the counties by population, and tried to gather intelligence for each nation across all four Media sectors. As always, reliable data for media usage generally stinks; in Europe, ça fait chier oeufs. So, yet again, the cartography is a work in process. Missing data for some regions is denoted, rather than simply omitted. However, countries without a minimally viable dataset have been left off (looking at you Austria).

With that context, my big European takeaways:

Europe is NOT like US. 63% of the world’s population is under 40. 52% of the US is under 40. In the EU, 68% of the population is over 40. Europe’s demography is the reverse of the rest of the world.

This older-centric population has created a slower and even more fragmented migration of Media behaviors over the last decade. This plays out differently in different Media segments, but relatively uniformly across Europe (with exceptions).

Just as importantly, the traditional European civic mindset has guaranteed ongoing public financial and regulatory support for European national Broadcasters unlike anything in American Media (although a lot like Canada). This has helped traditional European Media - notably Broadcasters - maintain majors shares in vital programming like News and crucially Sports (commensurate to a major European religion), despite limited economics. In many regions, many of the most powerful Media Platforms are not asked to be profitable.

That said… Europe’s Old Media is losing power, and audience, at the speed of the Concord (European joke no one under 40 will get). And despite a limit on comparable metrics, it is possible to look at data we have, and see patterns of America’s Media Maelstrom repeating themselves in the “Old Countries.”

In the US, streaming now accounts for about 40% of TV viewing. In Europe, usage and sub numbers for SVOD, even in overage-indexed Europe, is big and growing. Streaming likely accounts for 1/3 of European TV viewing; more in many territories. More importantly, in nearly all 18 territories covered here the 3 global streamers, Netflix, Disney, and Amazon, are the dominant forces. In The Nordics, Poland and Czech Republic, local or traditional players have made inroads. But, with AppleTV+ and HBOMax now dedicated to joining the big 3 in global expansion, Europe’s local players had better follow the BBC’s lead; planning by the end of this decade to fully migrate all their Broadcast to a single app for all their programming; from Radio to all the BBCs to all their educational content - A Beeb Lifestyle Bundle. European legacy media has many handicaps, but also numerous incumbent advantages. As global streaming figures out a new model, European TV has a moment to lean into its ingrained advantages, and get back out ahead of the curve. But, as with the BBC, they’ll need to change a lot of old world thinking to do so.

Unsurprisingly, European Audio is also über-dominated by global streaming giants. What’s surprising is how competitive it is. Spotify is the world’s biggest audio streaming platform. But it has major competition in Europe from the biggest companies on earth. Apple and Amazon both have notable music platforms (note that Amazon does better than Apple Music in most territories). But in the Old Countries, YouTube leads in Audio - for music and podcasting - in more countries than Spotify. And globally YouTube is nipping on Spotify’s Swedish heels. If you want to know how that’s possible, note that YouTube doesn’t just play in the Audio category, but also Social Media. With three Big Tech Death Stars all aiming their Audio businesses at Spotify, Europe is likely to be one of the most active fronts.

If you want to know why I bet on Microsoft playing to win in next gen Media, note how many countries Microsoft’s Minecraft appears in Europe’s Top Games. If you want to now why I think EA will have a hard time after they lose the license to the FIFA brand, count the countries where FIFA appears not only once, but twice. Also please note that Gaming data in Europe succhia le uova; so accurate reads in the segment are difficult - especially with Live Service and Mobile Gaming. That said, even with Europe’s upside down demos, Gaming feels poised for big growth and major competition in the region.

Remember, the Old World is super old. This helps explain TikTok’s lack of traction on Europe’s table. This is total usage, not broken down by age; and 20% of TikTok’s users come from Europe; so they are reaching a huge share of the continent’s younger citizens. Meta is mega across these territories, and given the region’s demos, they will remain so for the rest of the decade. However, once again, their biggest competition for platform dominance comes from the biggest players in Media and Tech. Apple is actively disrupting Meta’s business at every turn. Google has the #2 Social Media platform on earth, and also controls access to users, on Android, for all other social platforms. Microsoft has LinkedIn and Minecraft. And for Meta, TikTok is the sleeping giant that will likely wake and shake up the market, as demos finally shift in the decade ahead.

BIGGEST POTENTIAL RISKS ON THIS TABLE: HBOMax is way behind where they should be; Spotify has laser scopes on them from the world’s biggest companies who want to win in Audio; EA losing the FIFA name would scare tf outta me; the Broadcasters on the chart are woefully underrepresented in streaming - in Video and Audio; as the research demonstrates, few or none the traditional Media players in Europe have serious gaming investments, despite the growing size of the market there - this is a problem that will grow with time; Apple Music feels behind schedule given how long they’ve been in the business; and Microsoft looks vulnerable to European anti-competitive regulation in Gaming when you look at their place on the table.

BIGGEST UPSIDES ON THE TABLE: The BBC gets 3X the viewing of Netflix, forcing their users to migrate to slimmer, more personalized digital experiences in the next seven years is not just smart, it’s urgent, and likely precedent-setting for the region; if EA can survive with its new Soccer Brand franchise, they just saved billions; ironically, due to decades of inattention to Europe, Disco Brothers now has a lot of white space for HBO content; with the global giants slugging it out, smart regional and local streaming players like viaplay, VOYO and SKY could potentially thread the programming needle to create maximum leverage with CTV platforms, on their home fields; if Microsoft can close the Activision deal, it feels poised for explosive growth in Europe.

If you want to know who I think the biggest winners in Europe will be in the decade ahead, the global players are handicapped here:

One can also measure vulnerabilities and opportunities for major European Media, by holding them up against this scorecard.

OR you can join me for my monthly webinar, this Thursday at 4:30p ET/1:30p PT, where I’ll discuss:

The European Media Table

Why 2023 will be a year of Lifestyle Bundles

My Top 11 Predictions for 2023 (this one goes to 11!)

THE WEBINAR WILL BE AT THIS LINK. You WILL need a password for the zoom.

If you see the password below, thank you for being a paying sub! If you don’t, please consider trying the free trial, watching the webinar, heckling me, and then cancelling your subscription before you have to pay. I hope to see you there.

Genießt die Woche!

ESHAP

Keep reading with a 7-day free trial

Subscribe to Media War & Peace to keep reading this post and get 7 days of free access to the full post archives.