Happy Thursday War & Peaceniks. Ready for results?

We are deep into Media Earnings Season, and today on The Media Odyssey, Marion Ranchet are keeping score.

(Watch above or click here & listen.)

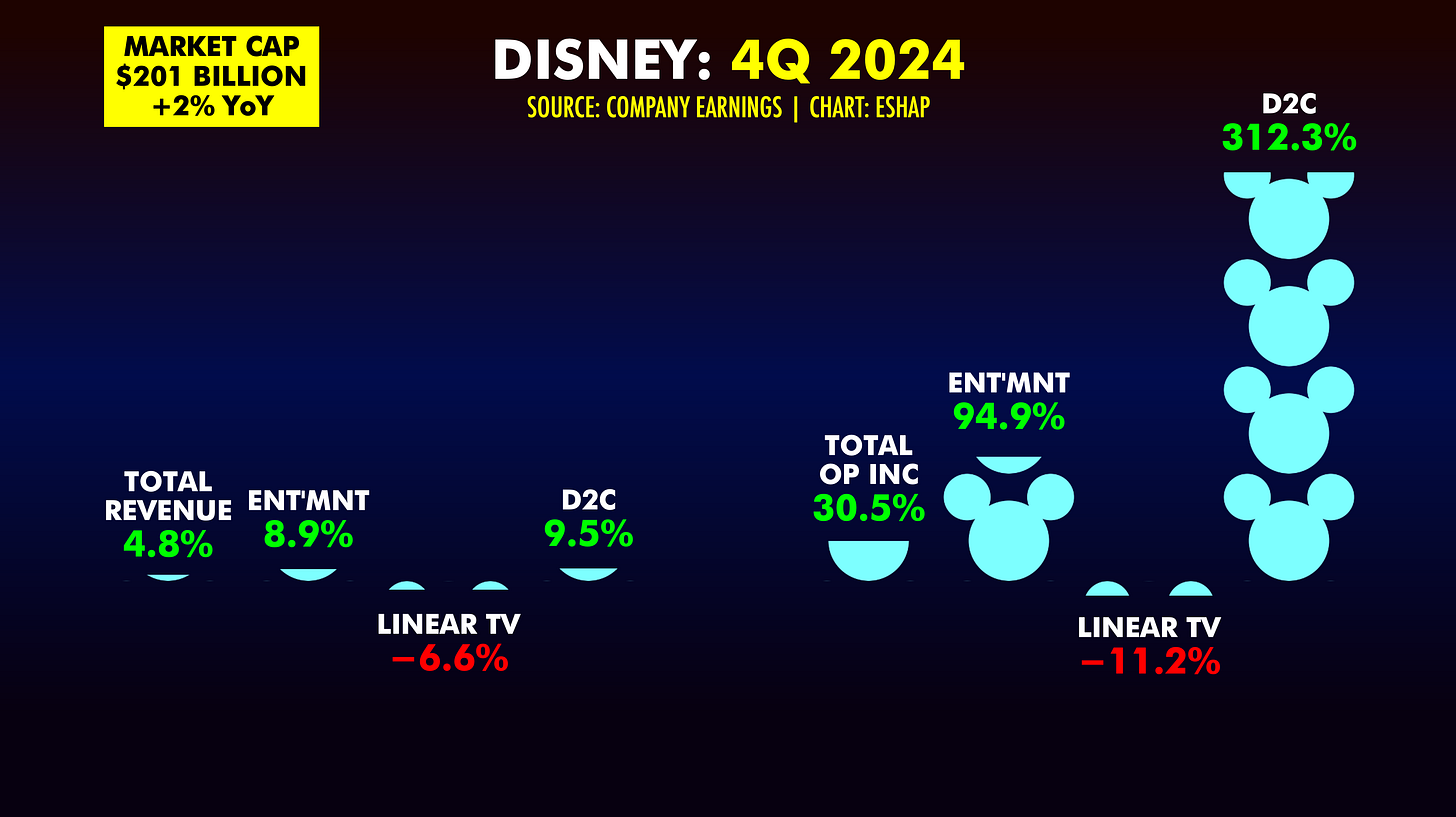

Disney offered some good results. But, as always, it’s all relative.

Total revenue was up +4.8%, largely driven by Streaming operations. But the big story is Disney’s Operating Income, up +30.5%, also driven by a big turnaround in Streaming, which flipped from a loss a year ago to a profit in 4Q 2024.

However, details matter, and this is why it’s important to read the earnings reports, not just the headlines.

Disney’s Entertainment division was the biggest chunk of their total revenues, and Streaming was the lion’s share of the Mouse House’s money. However, when you look under the hood of Operating Profit, 80% of Disney’s profit actually came from linear TV, with Streaming just above break even and the Parks letting the Mickey down.

This is why Iger, unlike his peers in Traditional Media, said he has no intention of selling the TV networks, defying the middle finger Netflix gave traditional TV in their earnings session. Disney is taking the profit from television, even as it shrinks, and reinvesting it in Streaming - specifically shedding low-and-no-margin subscribers for higher ARPUs.

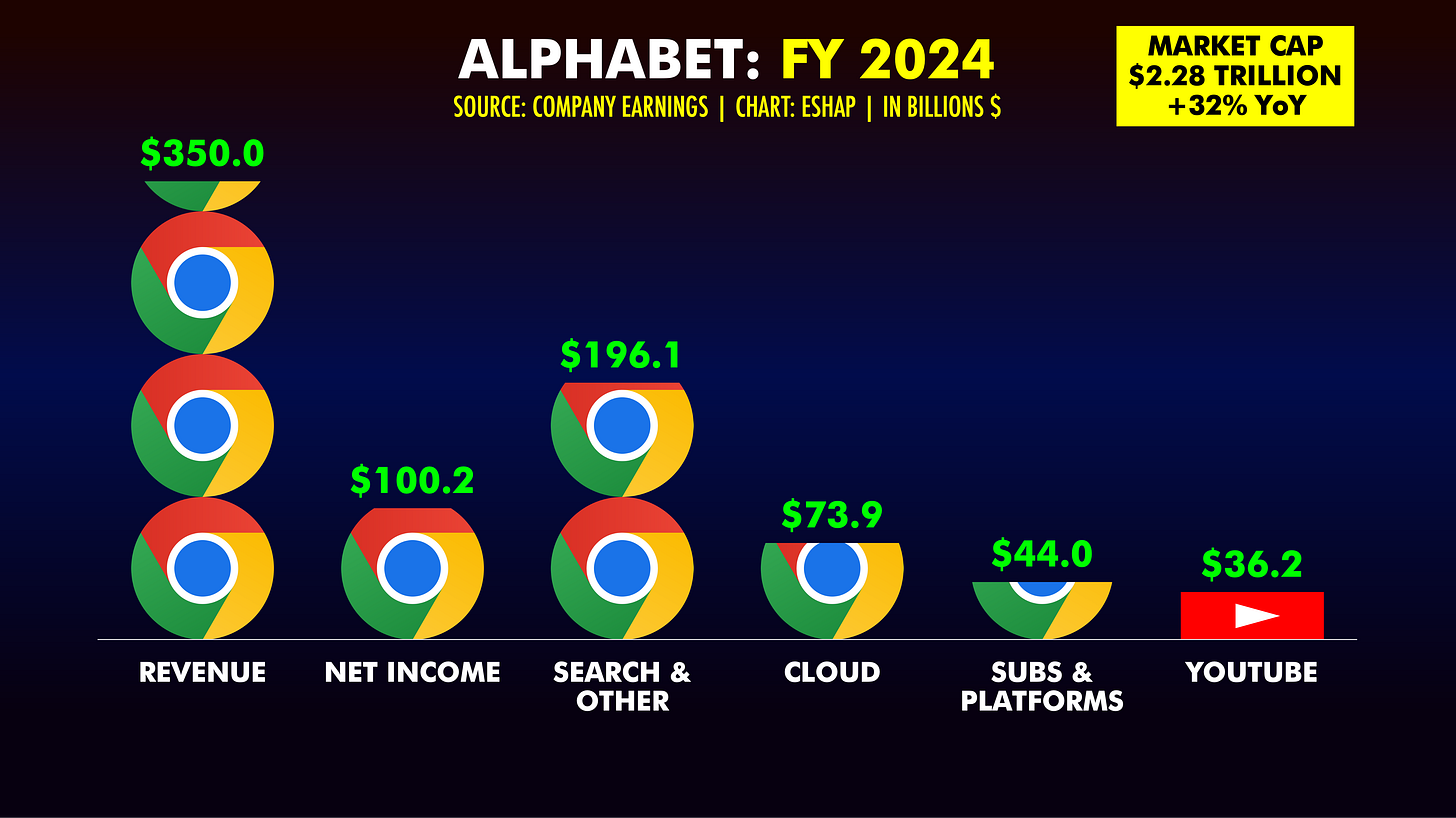

When you Google “Alphabet Earnings,” you get a confusing picture.

Alphabet’s Revenue was up +12% in 4Q, their Net Income was up +28%, and YouTube had its first $10 billion revenue quarter - garnering more than $36 billion for the full year 2024.

Yet, because Google’s growth was slightly slower than what the street wanted to hear, investors reacted by sending shares down. Wall Street shrugging off $100 billion in revenue and +28% Net Income growth is like grounding your sixth grader for only getting an A- in Calculus (has anyone really ever used Calc?).

Meanwhile, what is clear, is that YouTube is the one to catch on TV right now - which is why Netflix is stealing more and more of their programming model each day.

And then there’s Spotify…

The normally profit-averse Swedish mound of sound did something entirely unusual last year: They turned a profit. They also increased Revenue by +16% and Monthly Average Users by +12%.

Yet, despite 63% of their MAUs listening on the free ad-supported tier, Spotify has not grown ad revenues much at all. Subscriptions from their 37% of paid users still make up 87.3% of their total revenue.

Which begs the question: How did Spotify manage to turn a profit from their usual deep hole of losses? Answer: Layoffs and cutbacks. Which begs a bigger question: As the cost of music continues to rise, and Spotify’s payouts to artists still suck, what comes next? My answer: A sale.

Above, you can watch Marion and I go through the details, data, charts and slides, as we compare notes on these three pivotal players in the Media Universe. Or, you can click right here and listen to our dulcet tones to your heart’s delight on The Media Odyssey podcast.

Whatever you do, if you want a competitive edge in this business, I urge you (as I do each Earnings Season) to take the time to read the actual earnings reports of the Media companies you care about, work for, or compete with - or at least watch/listen to the podcast and pretend like you did!

Enjoy your weekend.

ESHAP