Disney's Missing $1 Billion

How I Can Make Disney Easy Money at Zero Cost

Happy Monday Peaceniks. To keep us warm on this wintery day, here’s today’s hot take…

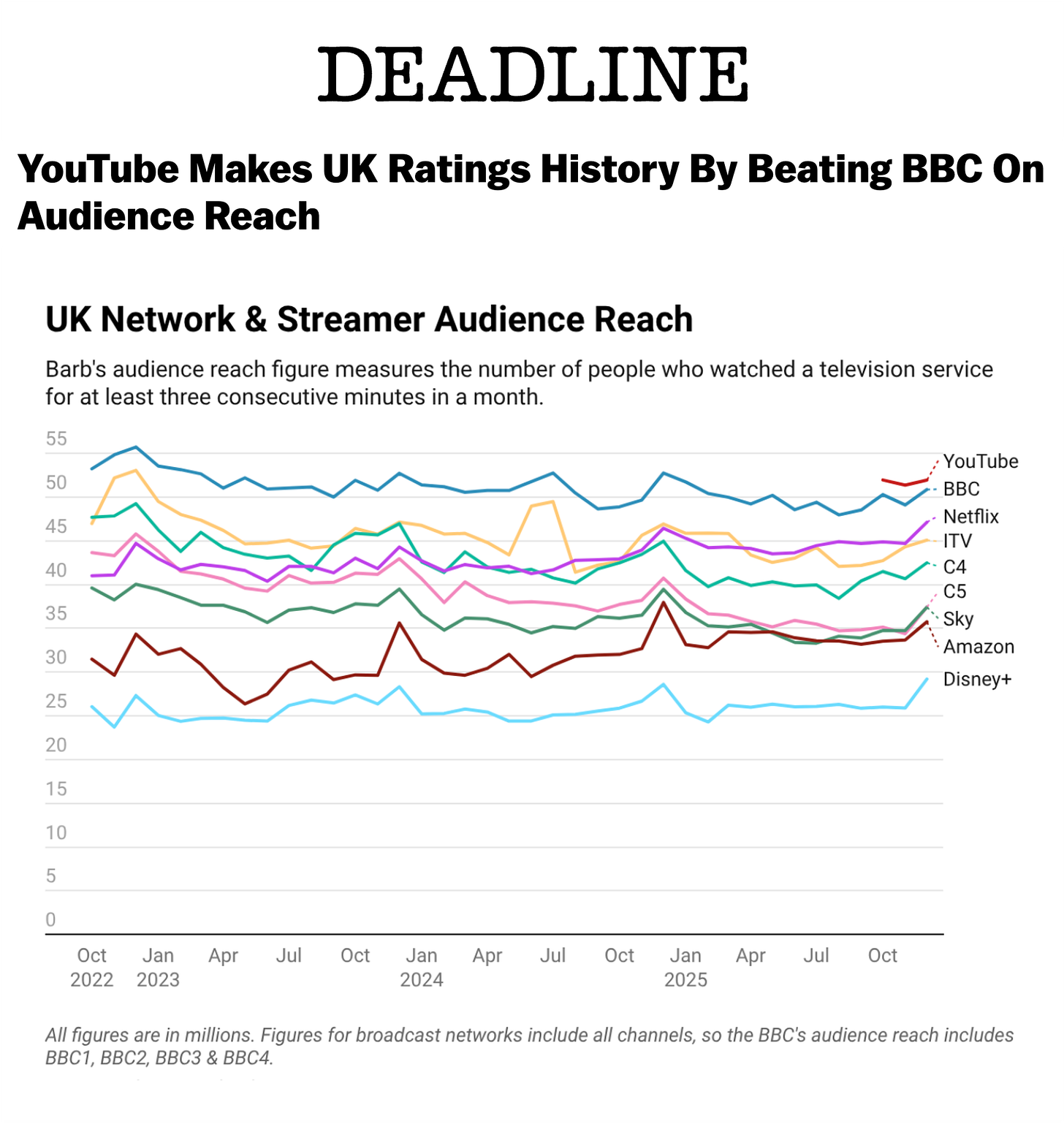

One of my big predictions for 2026 was that traditional Media would finally embrace Creator platforms and practices. Last week the BBC - the most traditional of all Media - paid off my bet already (and it’s only January!).

I’m glad that the Beeb (finally) decided to follow their fellow UK Public Service Broadcasters – and British audiences – onto YouTube to make my prediction true. At the same time, I wonder why the BBC is only making new, original content for YouTube, at significant cost, rather than also uploading their existing tens of thousands of hours of series and documentaries and/or live-streaming their daily news shows on the platform, all at zero cost to them - especially at a time when their budgets are under enormous pressure.

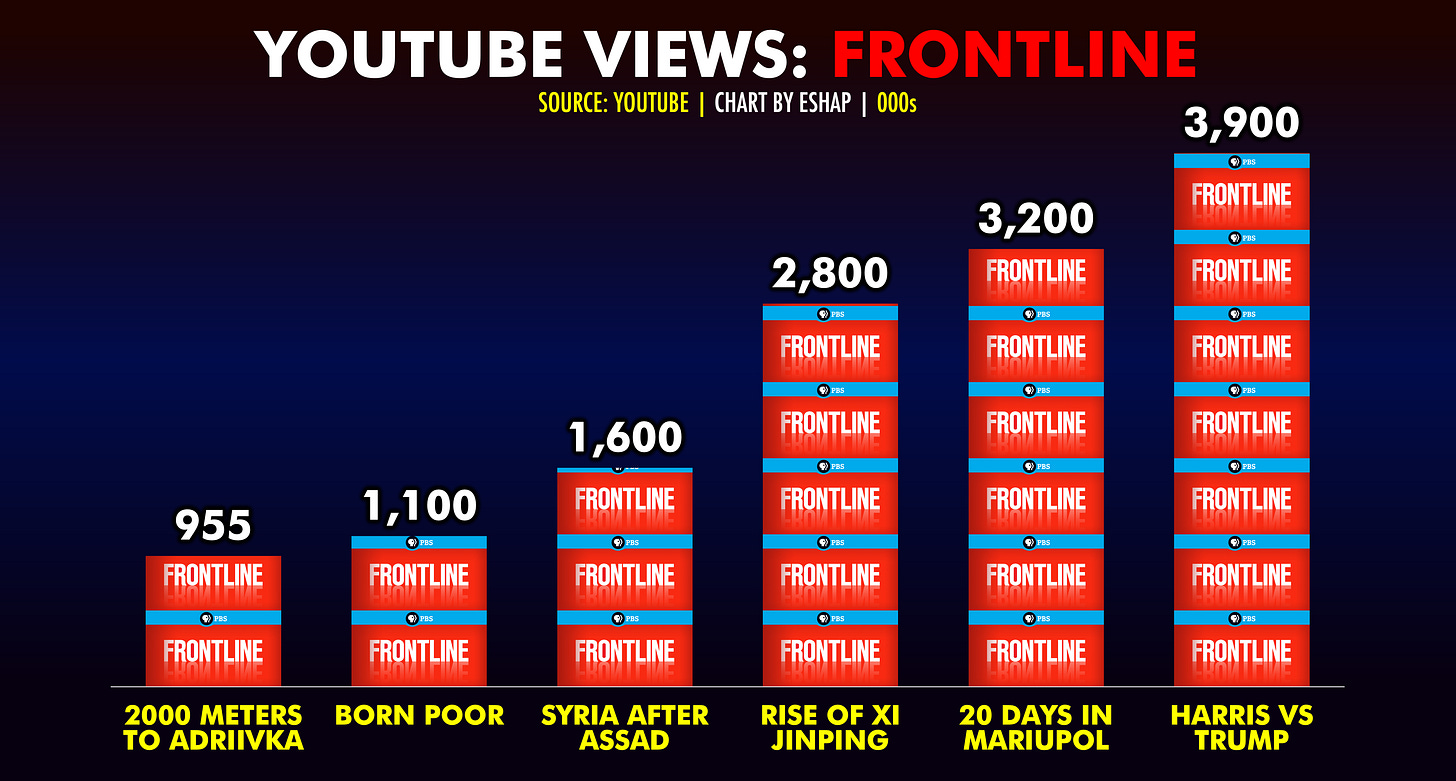

As we demonstrated recently with our PBS Frontline case study, when mainstream publishers distribute their existing, quality, long-form television programming on YouTube, it attracts new, additive, and large audiences of much younger viewers.

The BBC cannot monetize their social video channels in the UK. But, at this moment in the BBC’s history, the currencies that matter most are relevancy and trust. Tailoring content for Gen Z on socials is not a bad idea. But doing only that feels a bit dated. It assumes that Gen Z won’t watch your nightly news if you put it up each night. PBS disproves that with both Frontline and Newshour.

BBC can’t monetize social video in the UK. But they can and will outside of Britain. As we showed with our BBC Studios case study, the Beeb’s commercial arm is already very good at this.

The PBS and BBC Studios examples - together with efforts by CBC and Channel 4 - reveal how utilizing sunk-cost content to test and learn helps build new audiences and generate new revenues at low-to-zero-cost.

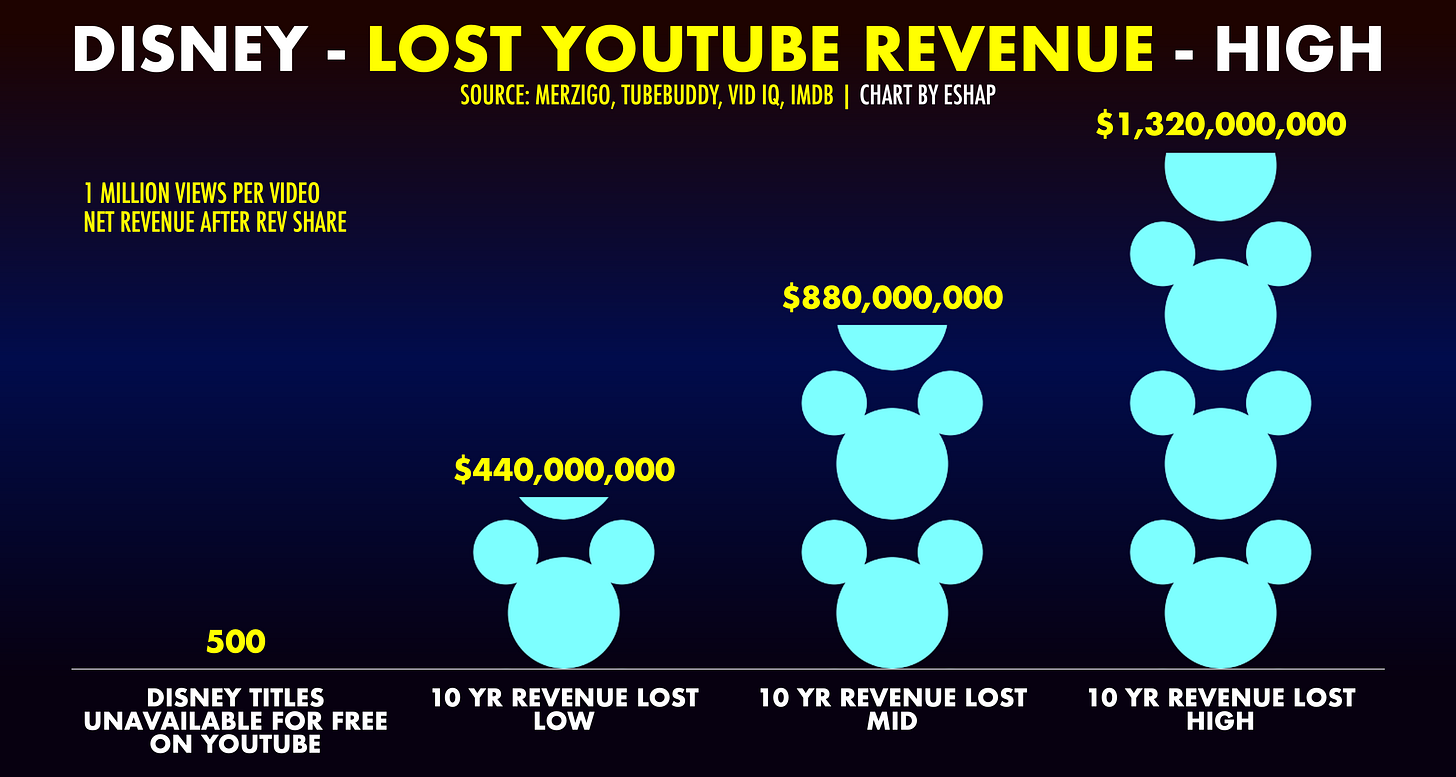

To model out precisely what I mean and show mainstream publishers what they are currently missing, I embarked on a research project on Disney’s IP with my friends at Merzigo. We strived to quantify just how much potential cash Disney leaves on the table, every year, by not unlocking their catalog to be consumed, for free with ads, on YouTube.

We began this research before the BBC announcement. We chose Disney because they currently make very little long-form content available for free on social video, making Disney’s perhaps the greatest unexploited library of content available in the world.

Our process and results:

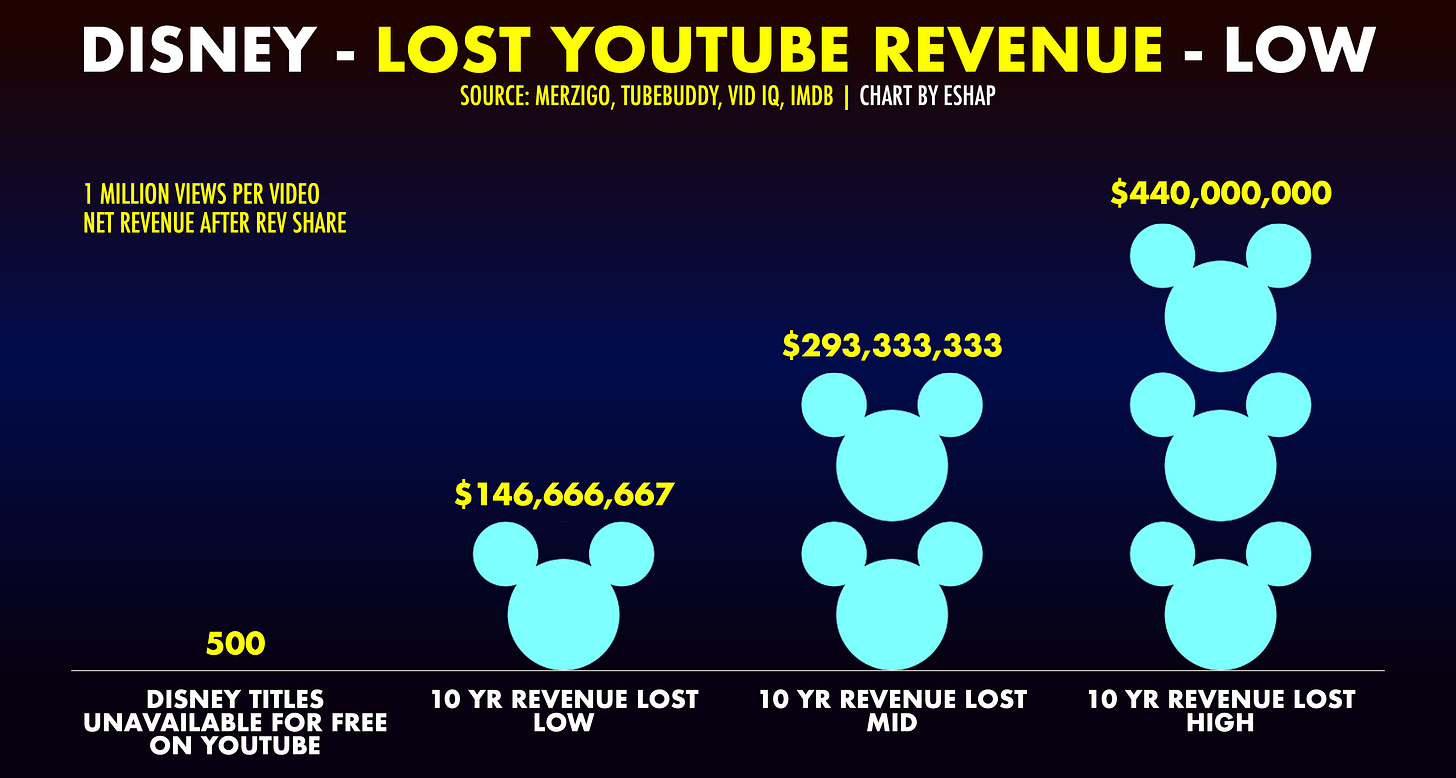

🐭 There are currently more than 500 Disney films/titles on YouTube for purchase or rental. None are available for free with ads.

🐭 RMPs (aka CPMs) on YouTube for premium content, especially feature films from publishers like Disney, range from $10 to $30. Films in YouTube’s Movies & TV section tend to get RPMs on the higher end.

🐭 While growing in popularity daily, Movies & TV (aka Free With Ads) is perhaps the most under-exploited content monetization outlet in Media.

🐭 Given the massive TV audience for YouTube today (now by far the top channel on televisions in the US and growing by leaps each month globally) one can assume that these Disney titles would be viewed tens of millions of times if made available for free on YouTube.

🐭 For the purposes of this case study, we started with the assumption of 1,000,000 views for each title, per year – a conservative projection.

🐭 We assumed the average view would be 40 minutes, average for feature films of 90 minutes or more.

🐭 We assumed 8 ads per 40 minutes – standard for YouTube views.

🐭 In one year, 500 titles with 1,000,000 views of 40 minutes each would generate 333,333,333.33 hours of view-time.

🐭 At an $10 RPM those 500 titles would generate $26.7 million - per year - in revenue. After rev-share, the net revenue to Disney would be $14.7 million per year.

🐭 At a $20 RPM: $53.3 million per year - $29.3 million net.

🐭 At a $30 RPM: $80 million per year - $44 million net.

🐭 Disney can generate $30 RPMs for their content - if they choose to sell it. First, it’s Disney. Second, they are very good at selling digital inventory. IF they did, they’d generate $440,000,000 in revenue over the next decade.

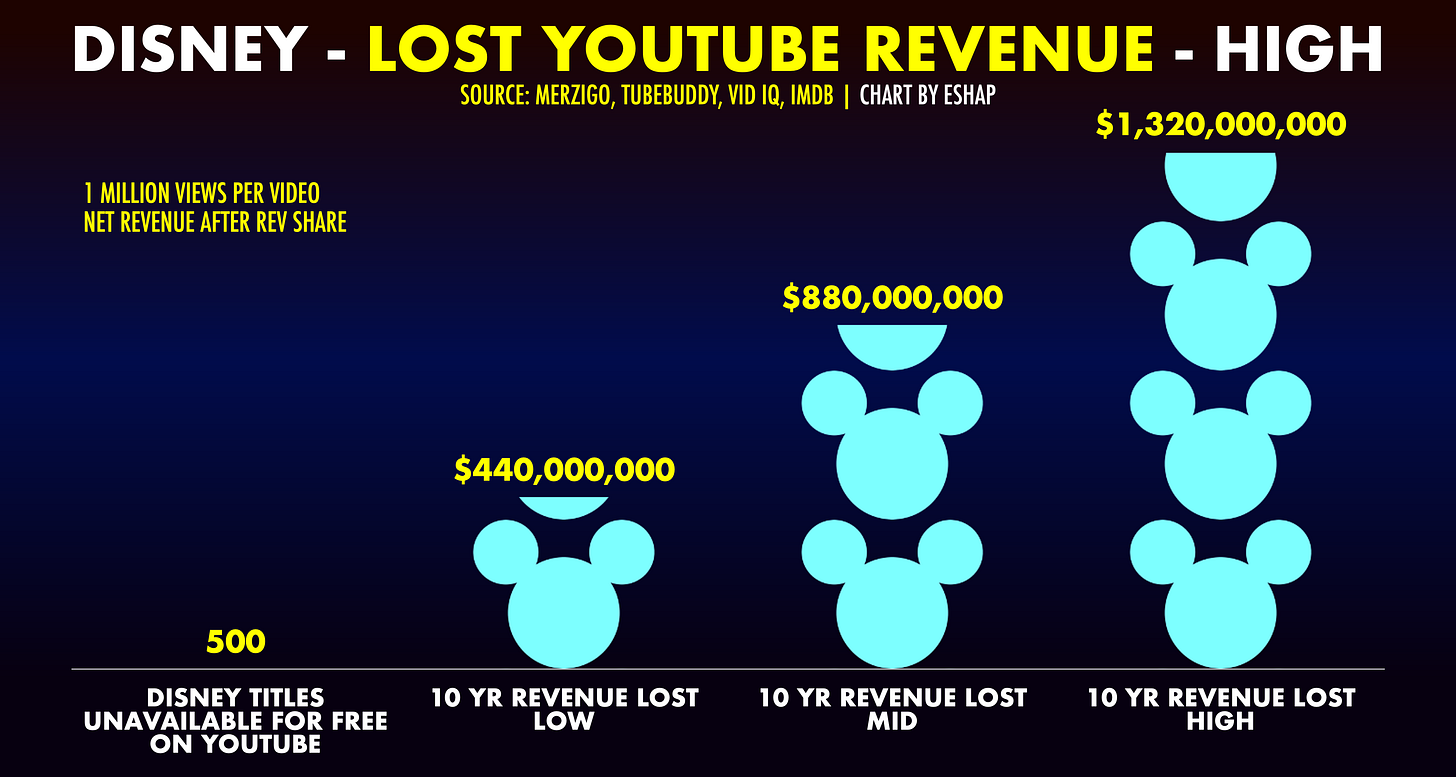

🐭 It is not unreasonable for the Disney film catalog (many of them big hits) to average 3,000,000 views per year. In that case, on the low end, they’d generate $44 million per year, $440 million over the next decade net; on the high end, $132 million in net revenue per year, and $1.32 billion by 2036.

🐭 Given the quality of Disney’s catalog and notoriety, 3 million views per year, per title, on YouTube, is doable. Depending on marketing prowess, so is 4 million. Keep running the numbers to figure out the cascading potential upside.

🐭 For a company the size of Disney, even $132 million per year may feel relatively small. Except… this is essentially ZERO COST revenue. All these films are already in the YouTube system. It’s a box-check to distribute them worldwide, and Disney already has one of the best digital ad sales teams in Media.

🐭 This is pure profit. Left on the table. In this economy?

Oddly there are dozens of poor quality versions of Disney films on YouTube, uploaded by third parties, entirely unrelated to Disney. Most look and sound like crap. Most are not monetized.

For example, Willow, Cinderella, and Ruthless People are all currently available for free on YouTube, with awful quality video, posted by random third parties. Willow has been watched 3.2 million times. Recently, Disney made a deal with OpenAI to allow its characters to be used in UGC on Sora or ChatGPT. Together, these datapoints betray an absence of strategy at Disney regarding its IP in the digital realm.

Conservatively, Disney is losing between $20-$100 million per year by NOT distributing their films for free with ads on YouTube.

Without overly aggressive projections, with a cohesive YouTube strategy, Disney has a visible path to billions in revenue over the next decade - likely more, in light of both TikTok and Instagram coming to TVs by the end of this year.

And that estimation is based only on their movie library. It doesn’t take into account the thousands of hours of Disney’s series, shorts, sports documentaries from ESPN.

Despite my criticism of the BBC’s approach, I respect that they are trying something. On the other hand, Disney not simply TESTING the ad free model with some titles, given the facts surrounding them on all sides, is mind-boggling.

What is the specific, untenable risk in choosing 50 of the 500 films, posting them in YouTube Movies & TV, and seeing what happens? If something goes awry – Disney+ sees a drop off in sign-ups; MVPDs set their hair on fire; the stock goes down – just f*cking stop. This is how the internet works: Test, learn, iterate. If it works, keep doing it; if it don’t work, quit it.

With the recent news out of the UK that YouTube is now beating even the BBC for in-home reach, it’s obvious that my “YouTube is TV” drumbeat is picking up steam, all over the world. When Instagram and TikTok hit TVs this year, the rate of change will accelerate. Just as they did with streaming, Disney will reverse itself on its approach to social video. When they do, everyone (all the big media publishers) will follow.

Do yourself a favor: get out ahead of it. Do the math on your own library. Look at how much money you’re leaving on the table. Don’t wait for Disney to change the game in Hollywood. Change it yourself. And if you work at Disney, call me maybe. I can do the math in person for you.

On Tuesday, live on my LinkedIn feed, I’ll offer yet another case study on transforming traditional TV for the Creator Economy. I’m interviewing Dilip Bala from Merzigo; Jon Loew, founder of Big Media; and Nancy O’Dell, legendary host of Crime Exposé about their new partnership to bring their show to YouTube and Facebook.

And, on February 3, at RealScreen, I’ll be giving a keynote presentation on Transforming for Now: Creator Economy Lessons for Traditional Media.

I hope to see you online or in Miami. Regardless, remember to enjoy your week!

ESHAP

Vault gonna vault!

There is a company based in Brisbane, Australia that has been offering this service for some time. It’s called Apocalypso.