BREAKING FAST

What comes after the FAST?

Happy Tuesday War & Peaceniks. Do you feel the need; the need for speed? (WARNING: This post included numerous, intended FAST puns… buckle up.)

Like the rest of the planet, the Media Industrial Complex love to follow trends. And the hottest trend in Media these days is FREE AD SUPPORTED STREAMING TELEVISION, aka FAST.

And for good reason…

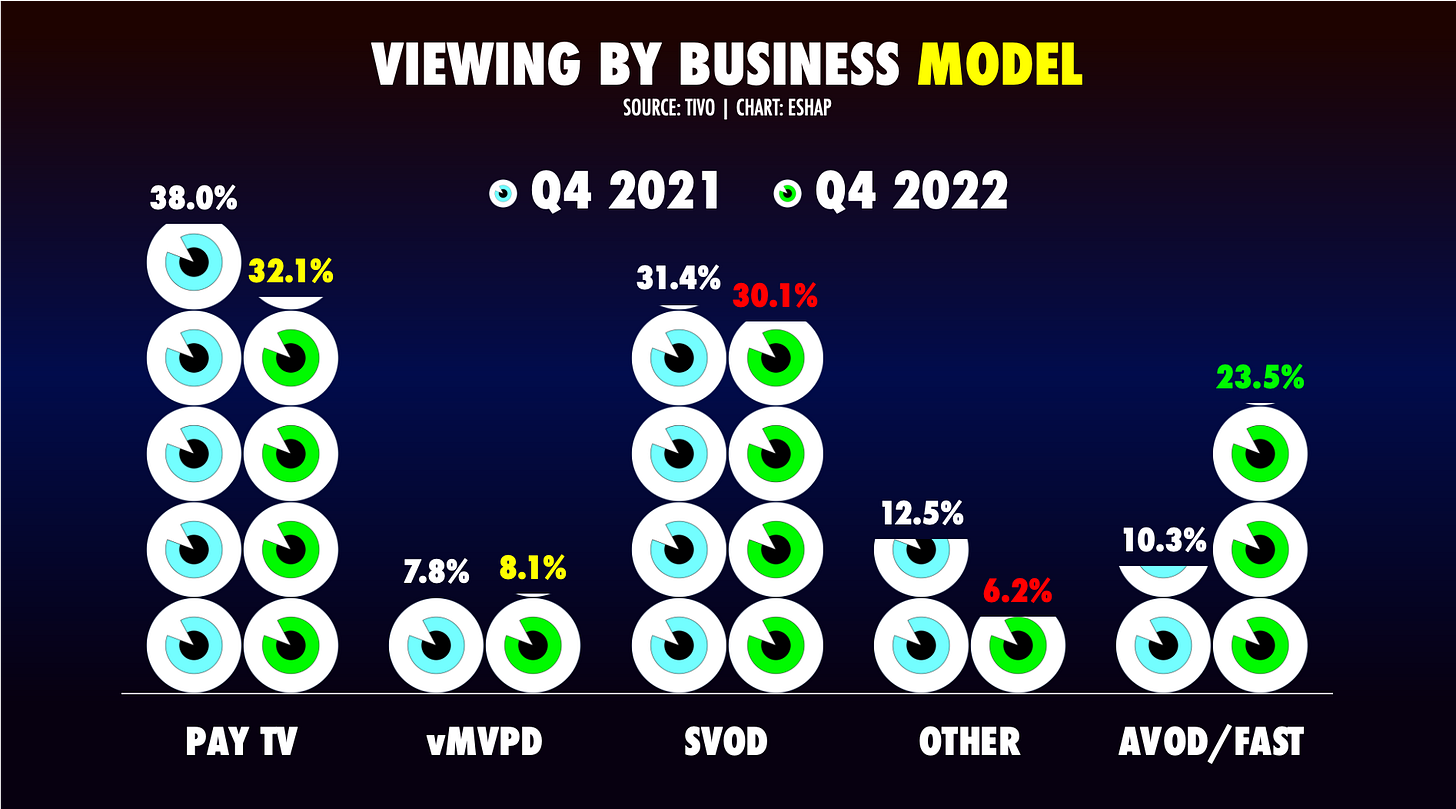

FAST and AVOD are now the fastest growing segment of the viewing economy. According to Nielsen (please take many grains of salt before clicking), FAST platforms Roku, Tubi and Pluto accounted for 3.4% of all TV viewing in July and 3.3% of TV viewing in August. But, before you jump on the FAST wagon too fast, remember that sometimes, data can be deceiving.

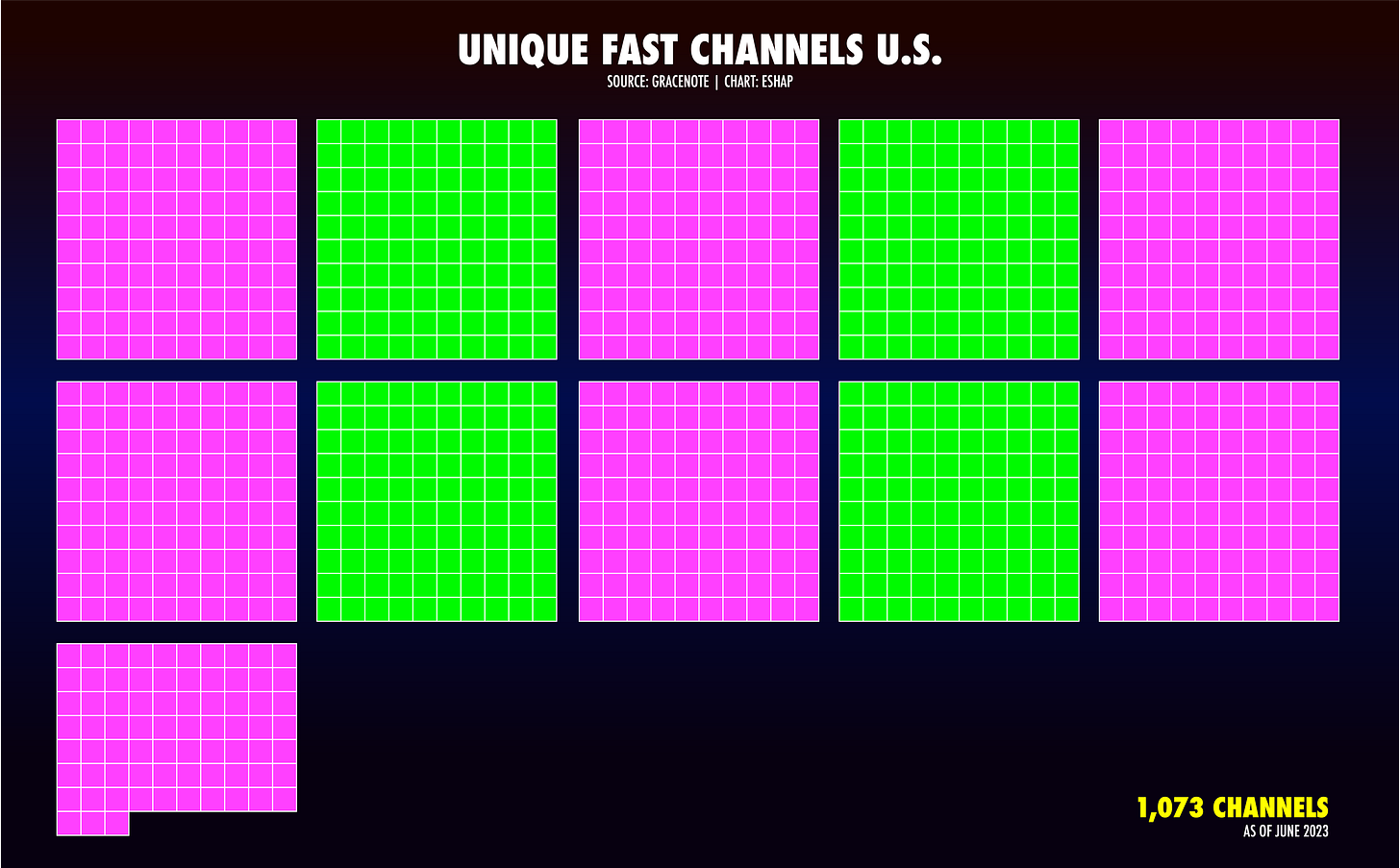

FAST viewing does not at all represent concentrated audiences, but rather small pockets of consumers, spread thinly over more than 1,000 channels in the US.

When you consider viewing on FAST platforms like Roku, Pluto and Tubi, do not think about each as a stand alone channel. They are, in fact, a grouping of hundreds of channels, with substantial overlapping content. Roku has more than 450 individual FAST channels. There are at least 220 channels on Samsung TV+. Pluto has than 350. Tubi has 200+ channels and more than 50,000 individual titles. Add to this FAST lane hundreds more channels on LG, Plex, FreeVee, Haystack, LocalNow, Sling, Red Box, Vizio and Xumo, and you can see why that chart above is so dizzying.

While nScreenMedia reports that two-thirds of American viewers now use FAST, this usage is even more fragmented than Cable TV used to be, with the average FAST channel getting approximately just 2 minutes of viewing per month. (It should be noted that usage data for FAST remains precariously elusive, so that average length of view per channel is from 2021.)

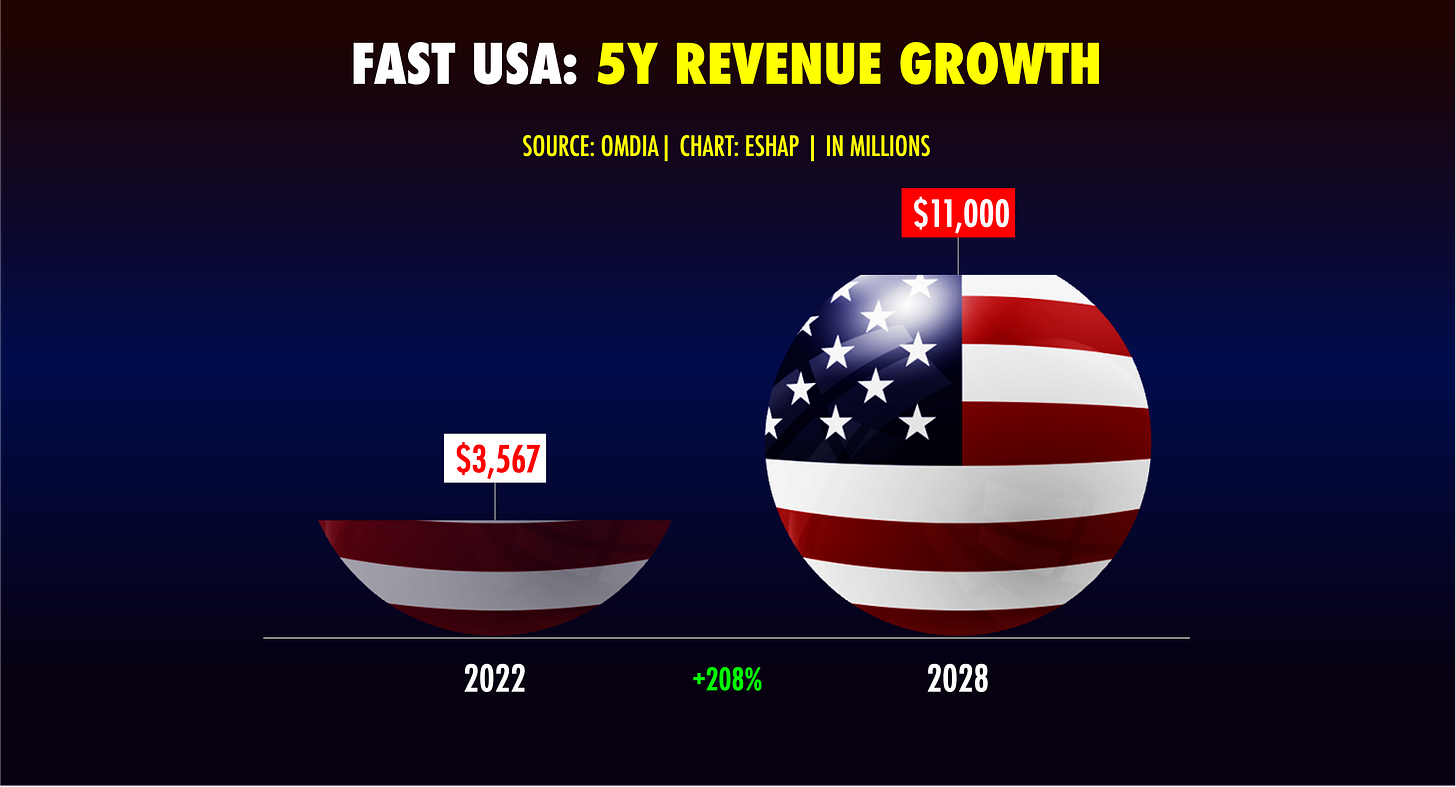

This is NOT to say that FAST is not a good business. Omdia projects that FAST revenue will grow 208% in the US over the next five years, to $11 billion by 2028.

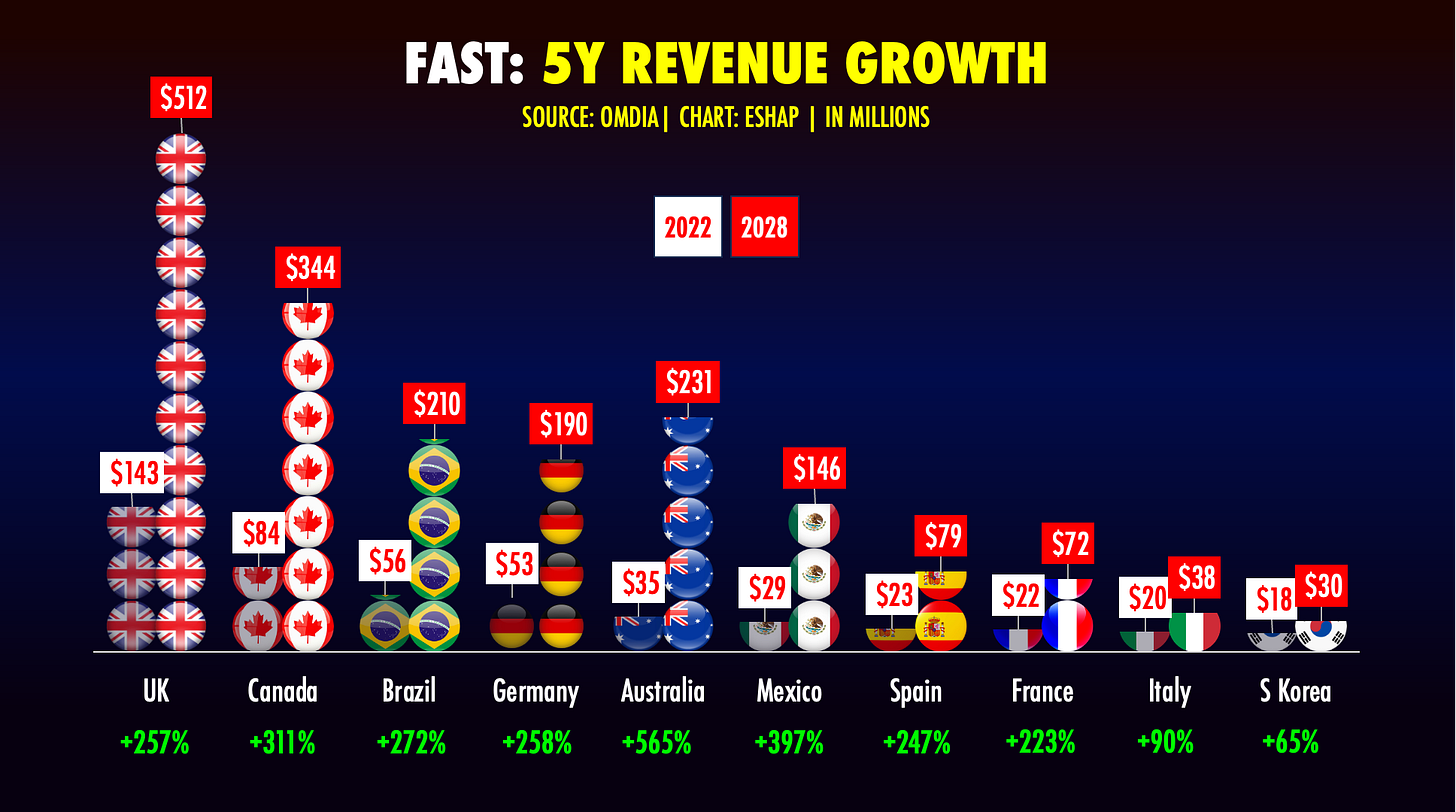

They also project fast growth for FAST around the world, with segment revenues growing by more than 250% in the UK, 300%+ in Canada, a whopping 565% in Australia, and high-speed growth of nearly 400% in Mexico and almost 300% in Brazil.

But let’s all recall that just few years ago, the same Media elite now sprinting into FAST decided that consumers no longer loved linear TV and also hated ads. Turns out they were wrong. Oops!

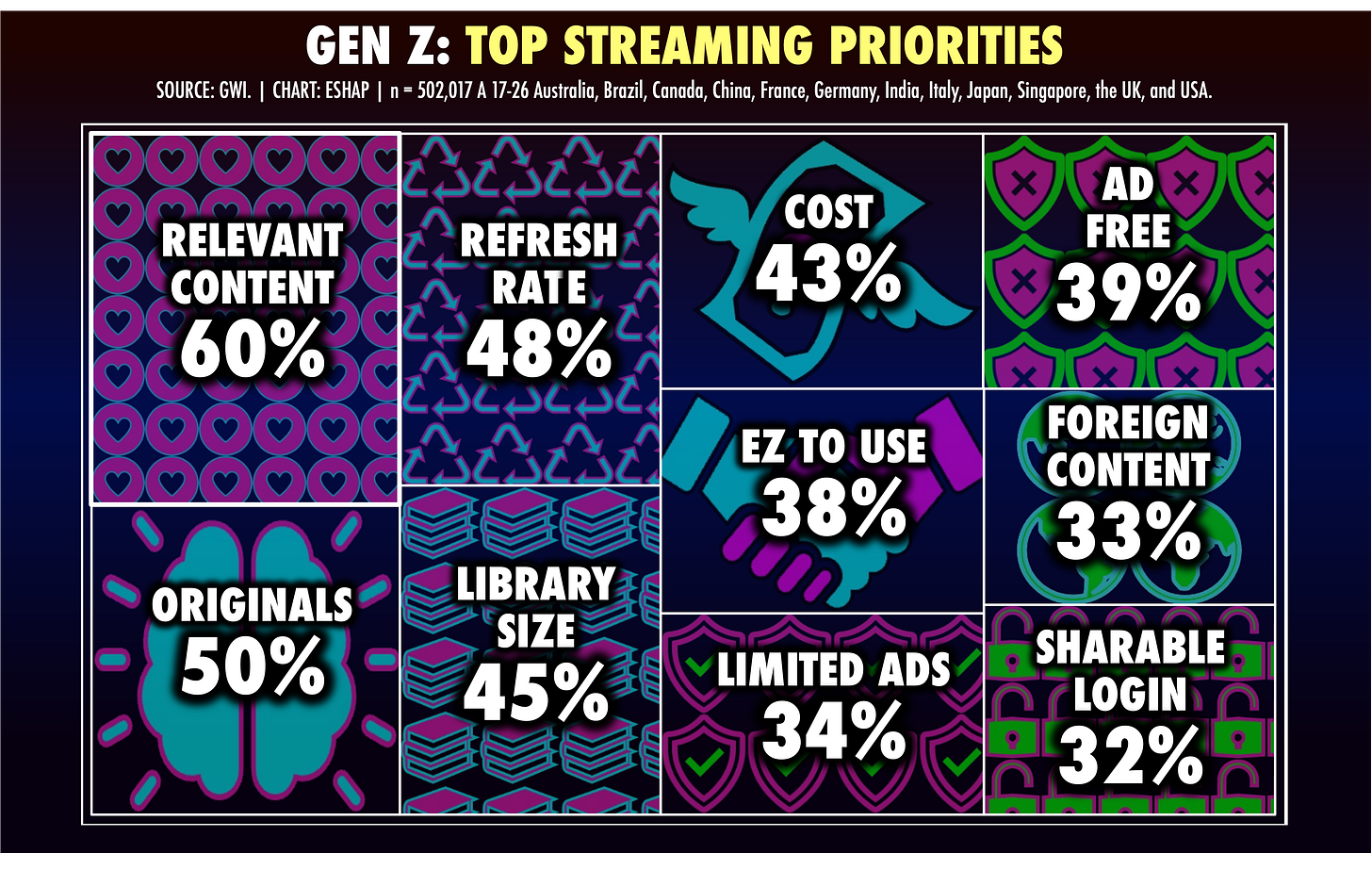

What consumers actually hated was the over-priced, inflexible cable bundle oligarchy, not linear TV, nor even the ads. Viewers (even younger audiences) want choice. They want a steady flow of stuff to watch. Their first (second, third, and fourth) priority is the relevancy and depth of the content they get, not the format, nor the ad load.

So there is an enormous amount of opportunity in FAST for publishers, platforms, and ad sellers, as well as for agencies and brands looking to reach audiences in content-safe environments, where, for the most part, viewing is linear and ads can’t be skipped.

And yet, in context…

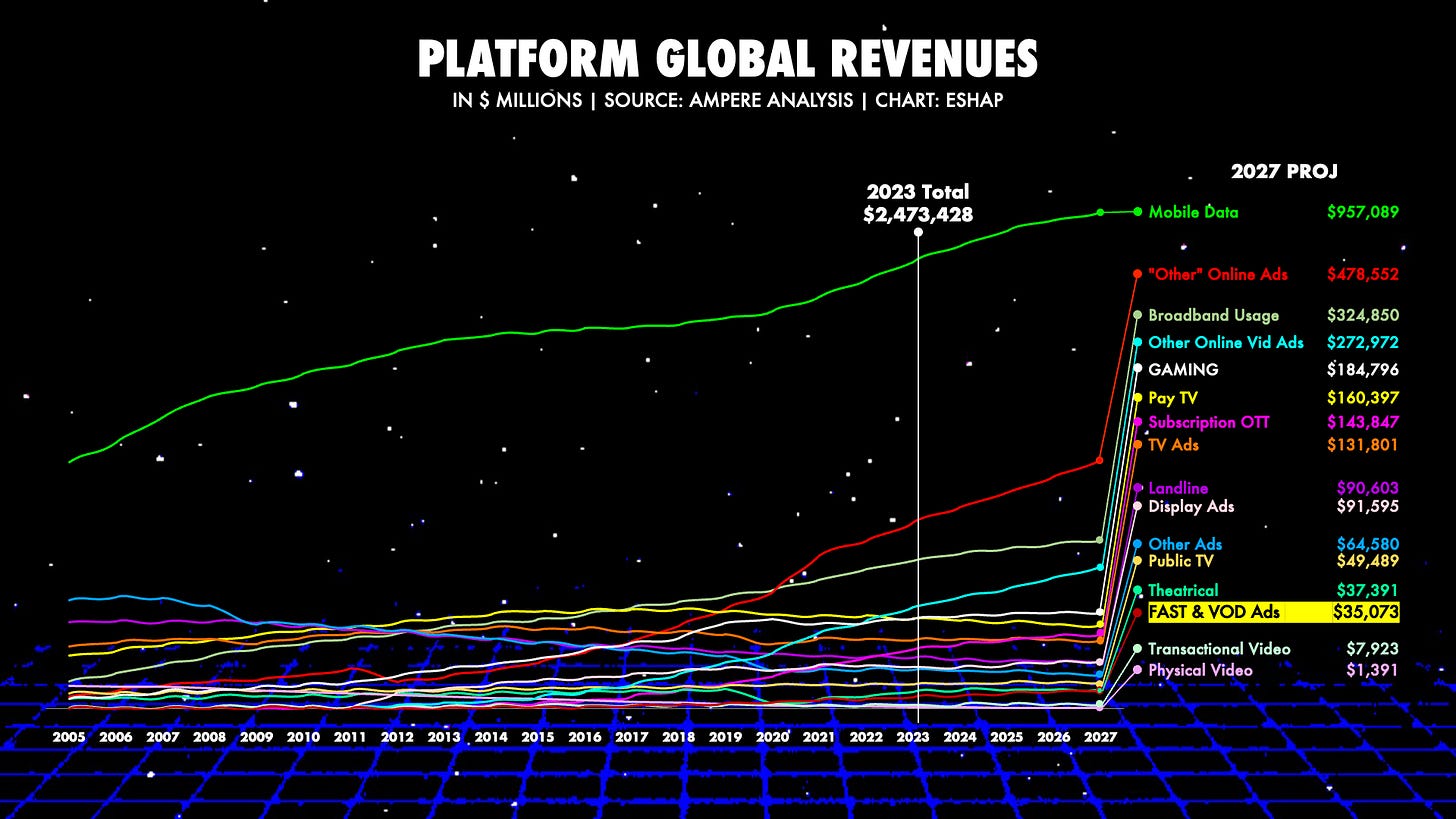

Even when you combine all of FAST and AVOD ads together, in Ampere Analysis’ projection for worldwide Media revenues, their 2027 total comes to approximately 25% of “normal” TV advertising, less than 40% of online display ads, and a tiny fraction of social and search advertising.

For context, Omdia’s 2028 projection of $13 billion in FAST ads is just 43% of YouTube’s projected $30 billion in ad sales for 2023.

So, while Free Ad Supported Streaming TV is quickly gathering a head of steam, there’s a not a ton of evidence that, by itself, there’s a great, long-term business model there. (Hence Roku’s recent layoffs.)

Remember, FAST publishers must split all their revenues with the FAST platforms, and inversely, the platforms must split their ad sales with the channel providers. Unlike cable, there are no subscription fees (hence the first name of FAST), so whatever’s left after the splits, is what you get.