Happy Friday War & Peaceniks! Ready to navigate?

Above is the latest Media Universe Map, redrawn for my European trip to MIPTV, London, and Warsaw. It’s part of a HUGE set of research we just completed, encompassing Media usage in Europe and the US, all of which I’ll be unveiling at MIPTV and at EBU in May.

This 👆 Media Map is my first to include several key European Media players such as Viaplay, the mega Nordic TV/streaming company; Group M6 and TF1, the major French TV platforms (who join Vivendi/Canal+, already on the Map); Mediaset, the big cheese in Italian Media; and Prosieben, a big player in German Media (who joins Bertelsmann and RTL already on the map).

Speaking of Europe, as promised, here’s my full new Media Table for Europe…

Much of the data for this Media Table was provided by Ampere Analysis, who’s Guy Bisson will also be presenting at MIPTV. I know this map is enormous, so I’ve also sectioned the Euro Media Table into three downloadable, more-easy-to-read sections posted at the bottom of this newsletter.

And speaking of global travel… For the first time in more than a year, a brand new Map of FAST - including a view of channels from Europe, Canada and Australia!

As you may know, because I’ve complained about it here often, FAST usage data is hard to come by, and when found, generally not entirely reliable. So instead of trying to chart FAST viewing, my partners at MediaBiz gave me access to their data tracking the number platforms, channels and channel exclusives.

I was hoping looking at this dataset from on high would provide visibility to emerging trends. And I think I was right. Since the starting gun of the race to FAST, the focus as been on tonnage: Get the channels up there, make them free, generate views, sell ads - no need for exclusive windows, now way we pay licensing fees. But the Disco Bros licensing deal to Roku and Tubi felt the start of a new FAST era, where exclusive windows, and exclusive FAST channels, matter.

I promised my partners at MIPTV to NOT spoil my speech in Cannes, so I’ll write more about this after I present in Europe, but… Look at the % of exclusives on the various platforms in the various territories. Look at the share of exclusives on Local Now. And on Pluto TV. The pattern this data shows my eye: Global FAST platforms will need to bring a massive amount of exclusive content to the table to matter around the world, because regional and local players (see ITVX, all the Aussies and Local Now) will have the ability to provide native, exclusive content that generates utility viewing (News is so key here) and differentiates from the swarm of international FAST. Just as Cable TV found as it matured, simply running stuff you can find everywhere else is not a long term solution - and Cable had TWO revenue sources, not just ads!

Speaking of TV, we spent a lot of time digging into the differences between the US Media and Media in Europe. Earlier this week, I wrote about how very different these ecosystems are, and why Europe’s major Media players can and should avoid the American Media Apocalypse.

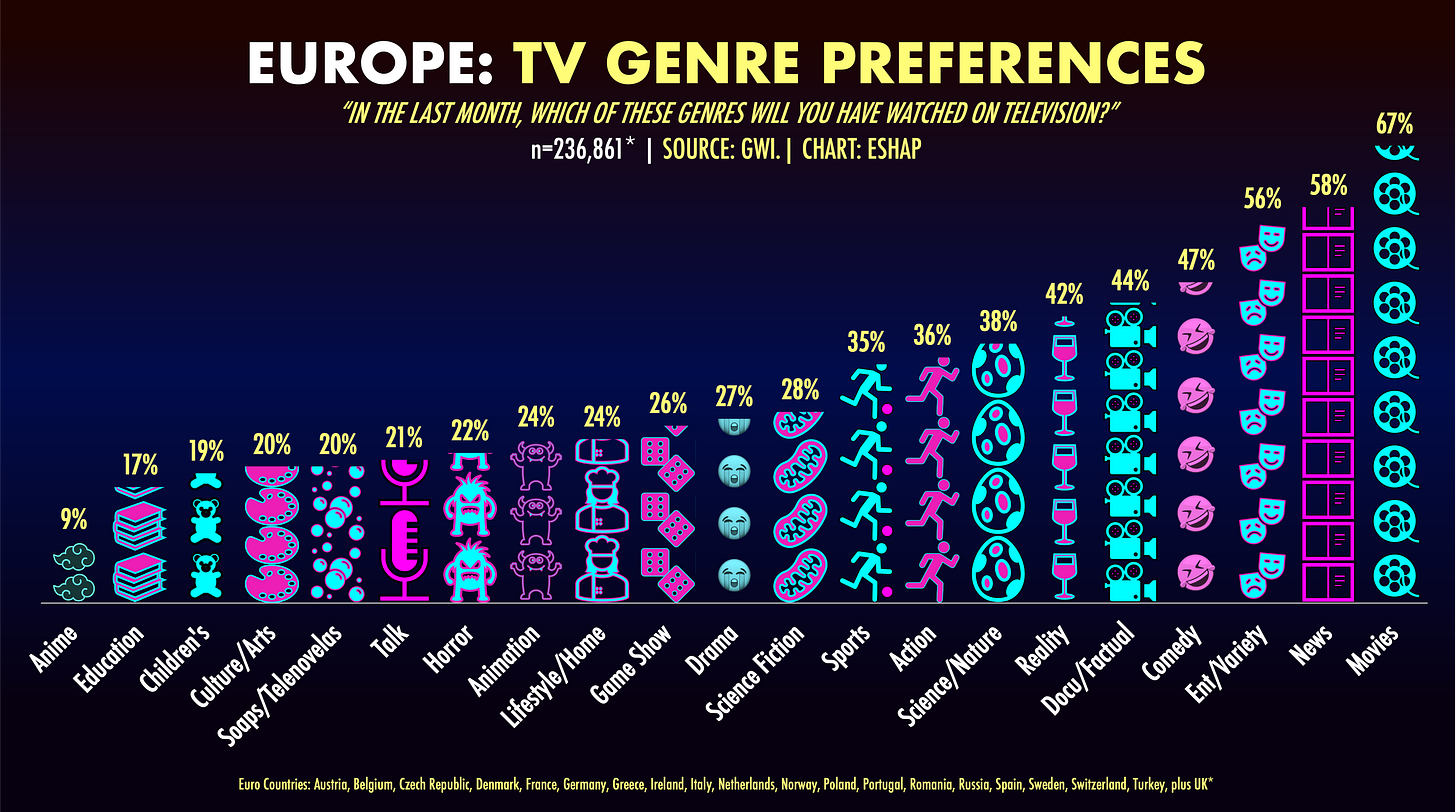

But the business models are not the only differences. Here’s a comparison of US and European TV tastes based on data from GWI.

There are some similarities, but also some major differences in content priorities. Some of that is explained by the different cultures, but much of it can also be explained by this…

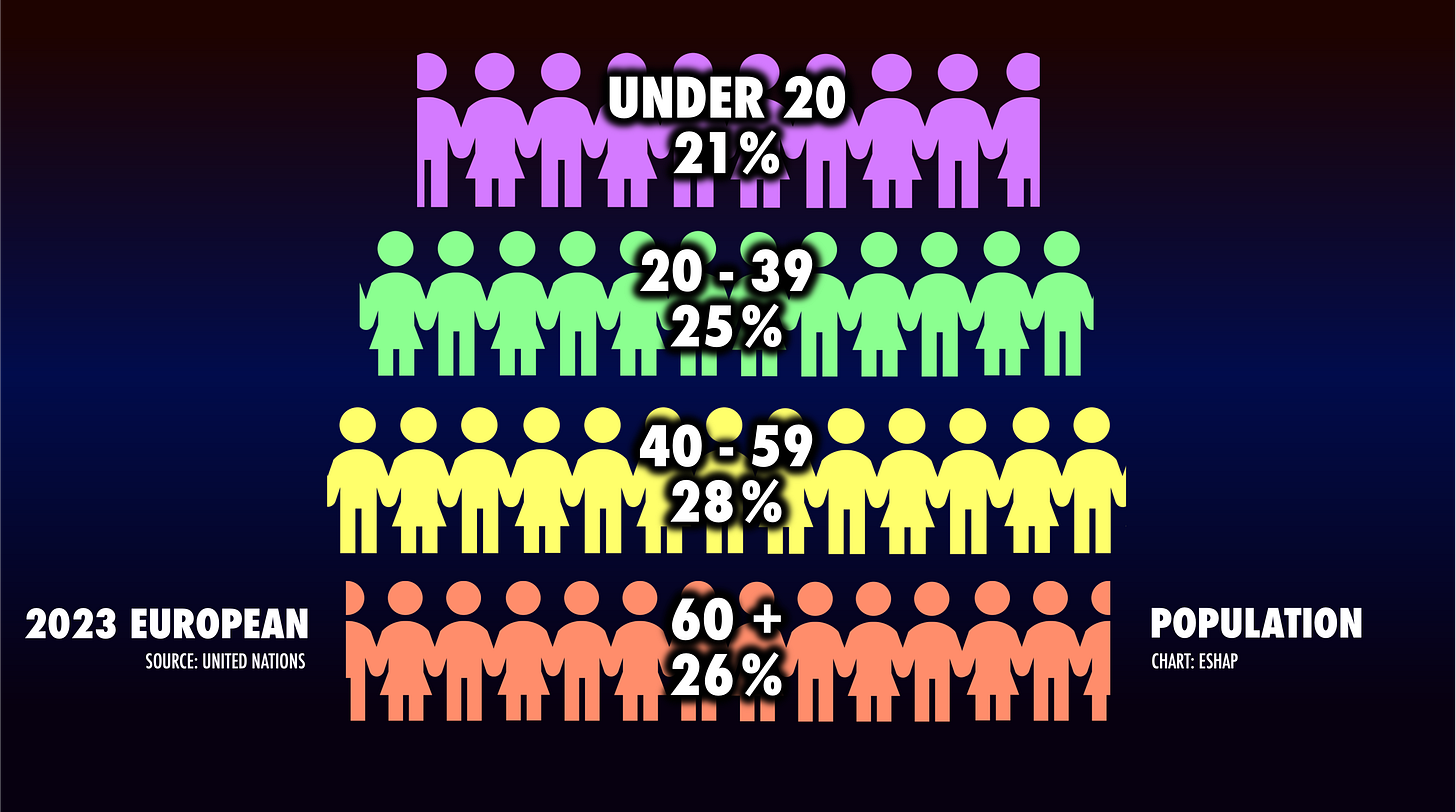

The majority of Europeans are over 40. The majority of Americans are under 40.

This generational disparity also partially explains the slower migration from TV to streaming, the slower adoption of music streaming services and even far less usage of TikTok. But, it should be noted, both continents are far older than the rest of the world.

Just 46% of Europe’s population is under 40 and 52% of Americans are under 40. Whereas 63% of the world’s population is now under 40. Whenever it feels like America and Europe truly do not get the rest of the world, remember these charts.

NOTE: If you see the three Euro Media Table sections below, and a higher res downloadable Media Universe Map, thank you for being a premium subscriber! If you don’t, then THINK about getting the free trial, getting the charts, and then cancelling before I get to charge you. All the cool Europeans are doing it.

I’ll be writing a lot about all this in coming weeks. But for now, my bags are packed, my passport is valid and I’m off to the Old World!

I will post next week from Europe, reporting to you from the world’s biggest TV market. Until then…

Profiter du week-end!

ESHAP

Keep reading with a 7-day free trial

Subscribe to Media War & Peace to keep reading this post and get 7 days of free access to the full post archives.